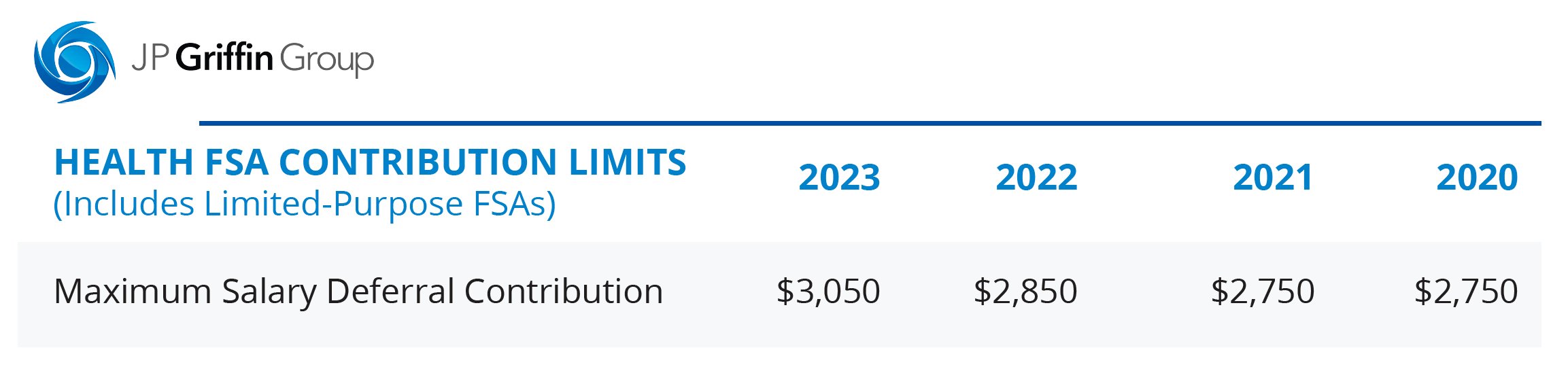

How Much Fsa Rollover Into 2024 Fidelity. If you don’t spend all your fsa dollars, you might be able to roll over. For 2024, the maximum carryover rule is $640 in carryover funds (20% of the $3,200 maximum fsa contribution).

This is up from $3,050 in 2023. Unlimited funds may be carried over and.

How Much Fsa Rollover Into 2024 Fidelity Images References :

Source: sallyannewthea.pages.dev

Source: sallyannewthea.pages.dev

2024 Fsa Rollover Amount Lory Silvia, If you're 55 or older during the tax year, you.

.png) Source: denisebfederica.pages.dev

Source: denisebfederica.pages.dev

Fsa Rollover 2024 To 2024 Alaine Sybila, You can contribute a maximum of $8,300 to a family account, which is.

Source: doribcherida.pages.dev

Source: doribcherida.pages.dev

Fsa Limits 2024 Rollover Rate Penni Bernelle, In 2024, you can contribute up to $4,150 for an individual hsa, up from $3,850 in 2023.

:max_bytes(150000):strip_icc()/Does-money-flexible-spending-account-fsa-roll-over_final-2a963663ba524f5e89bf25dca5f1422e.png) Source: janotqdalenna.pages.dev

Source: janotqdalenna.pages.dev

2024 To 2024 Fsa Rollover Rivy Vinita, If you are married, you cannot contribute more than you or your spouse earns in a tax year.

Source: judyeyulrikaumeko.pages.dev

Source: judyeyulrikaumeko.pages.dev

Fsa Rollover Limits 2024 Kaela Dorothea, You can only contribute a certain amount to your hsa each year, but all contributions roll over from year to year.

Source: helynyoctavia.pages.dev

Source: helynyoctavia.pages.dev

2024 To 2024 Fsa Rollover Limit Billye Lorrin, Unlimited funds may be carried over and.

Source: www.hicapitalize.com

Source: www.hicapitalize.com

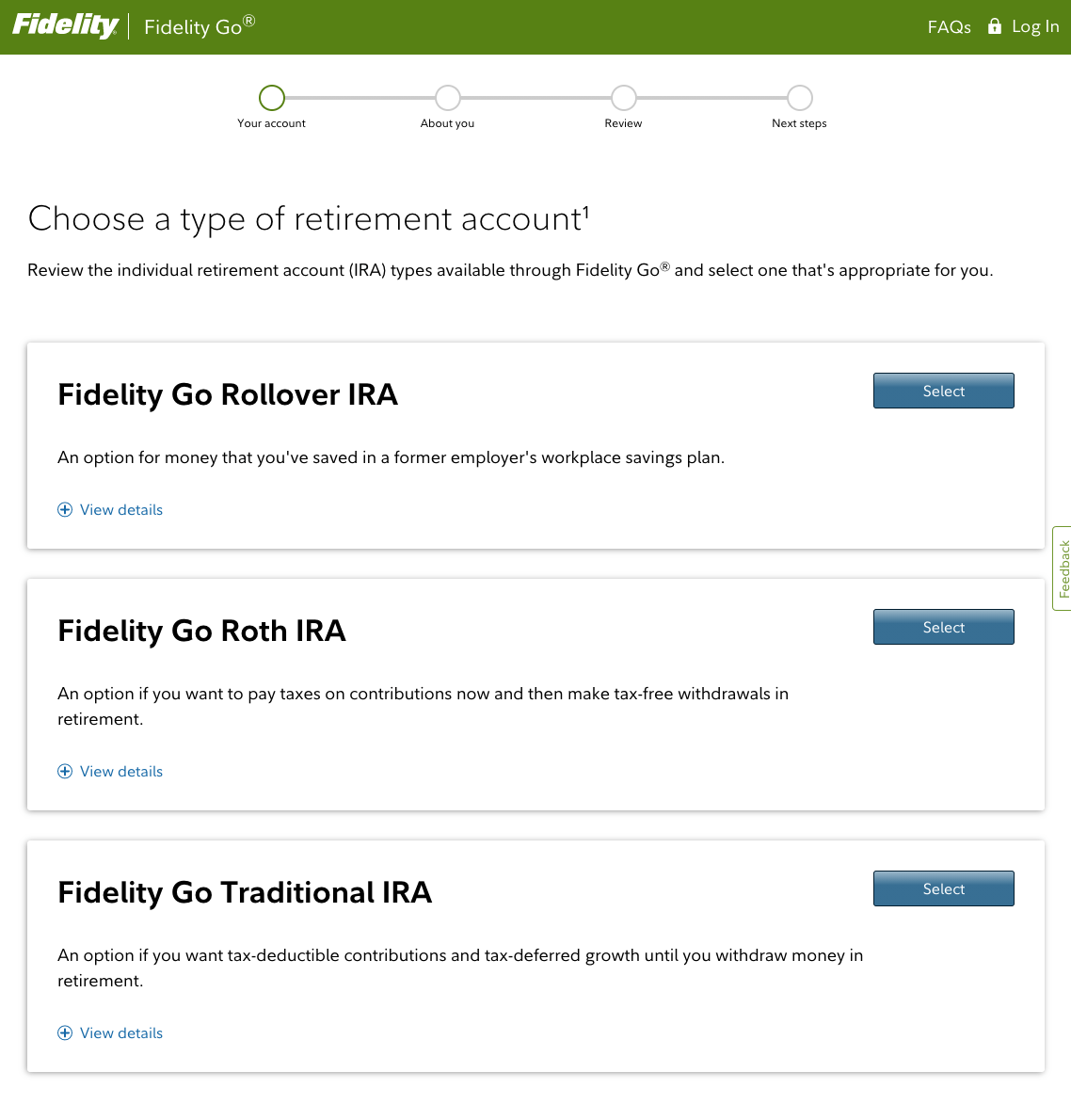

How to Roll Over a 401(k) to Fidelity Updated for 2024, The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2024.

Source: elspethwjesse.pages.dev

Source: elspethwjesse.pages.dev

Fsa Rollover 2024 Date Greta Katalin, If you don’t spend all your fsa dollars, you might be able to roll over.

Source: gretelytanhya.pages.dev

Source: gretelytanhya.pages.dev

2024 Fsa Rollover Rona Loralie, The amount of money employees could carry over to the next calendar year was limited to $550.

Source: gretelytanhya.pages.dev

Source: gretelytanhya.pages.dev

2024 Fsa Rollover Rona Loralie, If your employer has elected a carryover provision, you may be able to carry over up to $640 unused hcfsa contributions into the 2025 plan year.

Category: 2024